50-Year Mortgages: Why They’re Trending — But Probably Not for You

50-Year Mortgages: Why They’re Trending — But Probably Not for You

A Deep Dive into Mortgage Math (With Charts)

Lately, everyone’s talking about 50-year mortgages. They’re popping up all over financial news, social media, and even TikTok — all promising a dream home with “smaller monthly payments.”

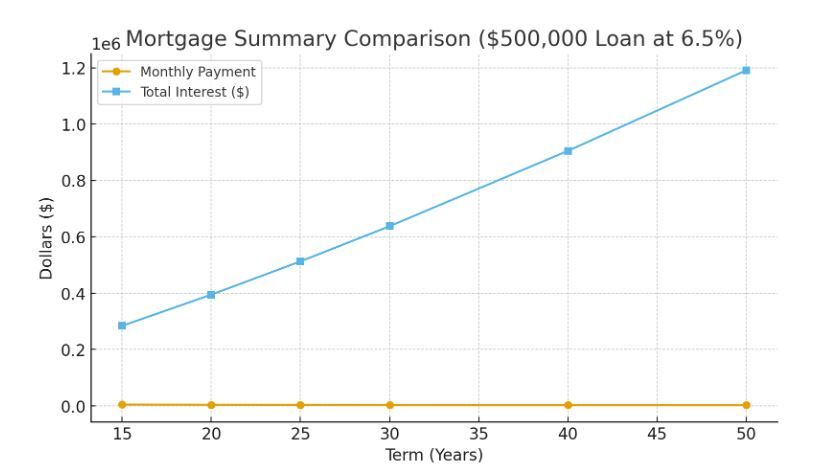

Sounds tempting, right? Who wouldn’t want to pay less each month? But before you jump on the bandwagon, let’s slow down. I ran the numbers, and after seeing the amortization charts on a $500,000 loan at 6.5%, I’m convinced this trend might be more trap than opportunity.

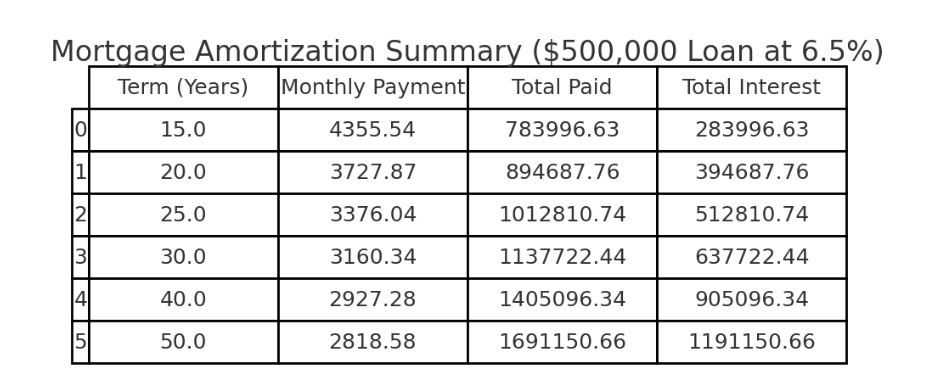

Here’s why they’re getting attention: those lower payments look like a win. On paper, a 50-year term brings your monthly payment down to about $2,819 — compared to $3,160 for a 30-year and $4,356 for a 15-year. For first-time buyers or anyone stretched by home prices, that sounds like a lifesaver. And let’s be honest — lenders love it too. The longer you borrow, the more interest they collect.

But here’s the problem — those low payments barely touch the principal. My charts tell the story: after 10 years, you’ve paid over $90,000, yet you still owe around $440,000. Two decades in, and you’ve built maybe 30% equity. That’s barely moving the needle.

If life changes — job relocation, growing family, divorce, or a market shift — you could be stuck. You might owe almost what the home’s worth, and that makes selling or refinancing tough. Compare that to shorter terms: on a 30-year term, you’re roughly halfway paid by year 15; on a 15-year term, you’re free and clear. Even a 40-year builds equity faster — about 50% by year 20.

Disclaimer: This is NOT financial advice — it's just me, some spreadsheets, observations, & a lot of numbers.

Bottom line? A 50-year mortgage isn’t a homeownership tool — it’s a decades-long lease from your bank.

If freedom and flexibility matter, look at 20- or 25-year loans instead. The payments (roughly $3,728–$3,300) are higher, sure, but you build wealth faster and pay far less interest long-term. You can even pay extra on the principal to mimic a 15-year payoff. And don’t forget — shopping rates or refinancing when the market shifts can save you thousands. (And yes, I know people who can help with that!)

So before jumping into a 50-year “solution,” take a look at the charts — they don’t lie. Build equity fast, create freedom, and don’t get stuck paying for the same house until retirement.

Comparing 15, 20, 25, 30, 40, and 50-year mortgage terms for a $500,000 loan at 6.5% interest.––

This highlights how shorter loans mean higher monthly payments but dramatically lower total interest over time — while longer terms ease monthly costs but add hundreds of thousands in interest.

Here, I compare each loan term’s monthly payment, total paid, and total interest for a $500,000 mortgage at 6.5%.

Categories

Recent Posts

GET MORE INFORMATION